A Practical Discourse on Money,

Economics, Finance & InvestmentWritten by Barry Beck

(combined from a series of talks I gave while working at Charles Schwab, Inc.)

Before money can be accumulated, understood or approached practically, we should try to demystify it and discern what it is and what it isn’t. Any form of money is worthless unless people believe in it. Historically, our conception of money has proceeded from the intrinsic value of usable and visible objects toward an abstract faith and trust in a concept. Money can be an instrument of desire, fear or pragmatic power (or an accounting device to reckon the distribution of desire, fear and power), a manifestation and projection of our individual and collective values. Today it is also electronic impulses registering credit on treated metal.

What is money and where is it located? It can be defined as a symbol of credit or an integral principle of reconciliation, harmonizing disparate elements. It’s a promise, a representation, a thought. It isn’t necessarily at a specific or expected location like a vault. It may be tied to assets (capital, land) or it may be in a ledger, on a piece of paper, magnetic strip, computer disk, cyberspace or in your mind.

Money is represented as binary digits on magnetized metal disk. A computer only recognizes and understands two things: the digits ‘0’ and ‘1’ (zero and one) in the form of impulses on charged metal. So our money exists as electrical signals; magnetic orientations or impulses on ferromagnetic oxide coated metal (silicon chips) representing binary digits (only zero and one.)

A Brief and Superficial Outline of the Evolution of Money:1. Barter in cattle (the word cattle is related to chattel and capital etymologically), beans, shells, skins, beads, jewels, crafts, labor, food, land. (40,000 BCE)

2. Commodity Money - Precious metals, primarily gold and silver. (6000 BCE)

3. Paper Currency backed or guaranteed by gold or silver (letters of credit, checks, currency, gold and silver certificates.) (13th century)

4. Credit (numbers in an account ledger or bank book.) (17th century)

5. Paper backed only by faith in credit, a government or a company (currency, legal tender, stock certificates and bonds.) (18th century)

6. Credit cards and electronic funds transfers (numbers on magnetic strip, computer disk or in cyberspace.) (late 20th century)

7. Perhaps in the near future, money and assets will be pure abstractions, invisibly tracked or agreed on by a collective computer or Mind. In the past, all our effort was applied toward the exploitation and manufacture of limited natural resources. Now with our information service society, the intelligence and creativity of each personal will may allow for unlimited commodities and abundance.

Each of these stages overlap with people having a little difficulty fully accepting the validity of each step. For instance, people will still store away gold even when cash is universal and will still store cash and stock certificates even though all is registered on computer.

Throughout most of recorded history (the last 8000 years), accepted value has been expressed as gold and silver. These metals were portable (small), malleable (easily molded), had value that could be agreed upon, were durable, and could be crafted into beautiful jewelry. They had a certain mysticism related to religion and alchemy attached to them. As the sun was thought to be twelve times the size of the moon, gold was thought to be twelve times the value of silver. Silver was set as 2/5 the value of gold in Egypt in 3500 BC.

As near as we can ascertain, banking originated in Mesopotamia. The Code of Hammurabi contained the first recorded (surviving) banking regulations. The Song (S'ung) Dynasty, which reigned in China from the 10th to the 13th century, was the first government to issue banknotes and paper money in 1023. Banking practices such as lending money and paying interest also existed in ancient Greece, but our present ideas of money began in medieval times. As commerce expanded, gold became too bulky for travel and safety. Goldsmiths were, in effect, some of the first modern bankers issuing letters of credit so travelers would not have to carry gold. Consequently, paper money in the form of credit, check or currency was always traded for, tied to, backed by or guaranteed by gold. With this basic rule (understanding, agreement) there was little or no inflation between the 1300’s and World War I except for short periods such as during the discovery of America (with massive new lands and gold), revolutions and the Napoleonic and American Civil Wars (when governments had to borrow or create money.) For instance, an ounce of gold was almost always 3.89 pounds sterling from 1660-1918. From the late eighteenth century to the early twentieth century, in America, an ounce of silver was about a dollar (silver dollar) and an ounce of gold was about $20 (twenty dollar double eagle gold piece.) During wars these prices inflated and during gold and silver rushes and discoveries prices deflated.

Very little new gold had been discovered since ancient times (5500 metric tons.) There are still perhaps only twenty yards cubic or 8000 cubic yards or 100,000 tons in the world. The first big gold rush was in the sixteenth century when Spain took in possibly 13 tons from American Indian civilizations. Major rushes in the nineteenth century reinforced gold’s importance to the U.S. and Britain. By 1900, all developed countries were on the gold standard (with currency guaranteed by gold bullion.)

Europe (even the victorious nations) emerged from World War I debt-ridden (mostly to the U.S.) To avoid fiscal ruin, France and Britain went off the gold standard. As a result of the Great Depression, in the early 1930s the U. S. banned private ownership of gold and established its price at $35 an ounce. (Incidentally, the term ‘depression’, as used financially, was initially encouraged by the Hoover administration as a milder word to help minimize the crisis in the public mind. Up until then, the words crisis or panic were used to connote great economic downturns. Ironically, ‘depression’ came to have even more dire associations in our thinking.) Another consequence of the Crash of 1929 was a public policy demand to establish more rules and ethics and less speculation in the market. In 1933, the New Deal brought about passage of the Glass-Steagall Act (which separated the activities of banks and brokerages; and the Act also insured bank deposits) and legislation creating the Security and Exchange Commission. In the 1980s and 1990s the perception of a need for separation of activities of banks, brokerages and insurance companies began to lessen as financial institutions were greatly deregulated (much to our detriment.)

The U. S. emerged from World War II as the only viably strong nation economically. America could set economic standards such as the price of gold and the dollar as it pleased. But during the 1960s, as Western Europe and Japan became economically competitive and the U. S. was strained by Vietnam and other Cold War and domestic commitments, the dollar lost value and silver was removed from U. S. coins. In the early 1970s, the government was impelled to terminate any attachment to the gold standard, since its gold was being drained by artificially maintaining gold at $35, then $42 an ounce. (By the way, most of the gold in the world is not at Fort Knox, but beneath the streets of lower Manhattan in the vaults of the U. S. Assay Office and the Federal Reserve Bank of New York held for U. S. banks and Central Banks of other nations for the purpose of balance of payments between governments.)

Modern Developments - 1970s - now:

1. Inflation (no more gold standard; free flowing currencies) - resulting in a need for more diversification and varieties in individual investments. Bank account interest rates no longer beat inflation. (What about inflation as wealth distribution? There is a harmful possibility called deflation which occurred during the Depression and in the late nineteenth century.)

2. Computers - allowing for greater transaction speed, theoretically less need for financial experts and newer more varied money instruments.

3. Discount brokers and more financial competition and more overlap of the roles of banks, brokerages and insurance companies.

4. Change from an industrial to a service economy - More people are providing a service than are producing or manufacturing material goods.

5. Expansion of a world economy (Germany, East Asia, Latin America, Former Soviet Bloc.)

Questions:Why are some people wealthy when others are poor?

• intelligence?

• hard work?

• talent / creativity?

• ambition / strong desire / will?

• attitude of confidence / preconceived self image / view of reality?

• education / experience / upbringing?

• rich relatives / marriage / inheritance?

• opportunities? / lucky breaks?

• fate / prayer / God’s will?

• social disadvantages / limited opportunities?

• bigotry and prejudice in society?

• lack of scruples?

What’s a bond?

To oversimplify, its an IOU issued by a:

• Government - now a days to help defer the national debt

• Municipality - for schools; to pay salaries or pensions; to build or refurbish infrastructure (buildings, bridges, highways, public works, etc.)

• Corporation - to raise money for reduction or restructuring of debt or for expansion of company

How would you react (in action and nerves) if your stock …

1. doubled in value?

2. dropped by 20%?

3. stayed stable for a year?

Why does a company’s stock fluctuate?

1. Intrinsic fundamentals - revenue (sales), inventory (products, overhead, employees), quarterly earnings, P/E ratio.

2. Perception of value - directional momentum (upward or downward trends likely to be enforced at least in the short run); sentiment (anticipation or expectation); reputations and rumors; latest news or statements by media or influential individuals; earnings of related companies or sectors; unfounded or diminishing expectations.

3. Speculation and arbitrage by large or institutional investors; decisions by market makers on floor of the exchange.

4. Technical analysis - the trends and numerical cycles of individual stocks and industry sectors. (See below for a definition.)

5. State of economy - real and perceived; overall and sector.

6. Interest rates and other economic indicators (the President and Congress have little and at best short-term influence on business and investment; of much more significance are Federal Reserve decisions on interest rates and normal business and economic trends and cycles.)

Over the next thirty days, would you rather I give you one thousand dollars each day, or would you prefer I give you one cent the first day, two cents the second day, four cents the third day, eight cents the fourth day, and so on, doubling the amount until the end of the thirty day period?

The purpose of my asking about the nature of wealth and the fairness of its distribution or why stocks prices fluctuate or what a bond is or how you would react in monetary situations:

... to draw out what you already know so you can perceive your knowledge in a different way and have more insight into why you’re reacting as you do (or if you need to) when prices shift or conditions change. (Also so I can get an idea how deeply I need to discuss each the following subjects.)

Investing Principles:

• Potentially, you know as much as financial professionals if you are observant and do a little research. No one is perfect and there will be unprofitable days, weeks, months or even years. If you pick ten stocks, they don’t all have to perform for you to make money. Even the most successful investors sometime make disastrous choices. Sometimes someone who has a great grasp of complex financial abstractions and statistics will not be able to make money and someone who does not follow or comprehend those concepts may make very common sense yet profitable decisions in their lives.

• Demystification of economics and wealth is necessary. The concepts, beliefs, terminology and jargon associated with a subject often make it more complicated than it should be.

• Diversification - hedges; definition of financial vehicles and categories. (See chart below.)

• History and path of stock transactions - ticker tapes, exchanges, market makers, computers, electronic funds transfers, brokerage web sites.

Theories of Numbers:

Rule #1 is to avoid debt; Rule #2 is to strive to invest. The sooner you begin, the faster and more impressive the result. Regular contributions and accrued interest on a tax-deferred basis is critical to wealth-building. The catalyst for a regular investment program is compounded interest.

An example: If you are twenty years old and want to have a million dollars by the age of sixty-seven, you need an initial deposit of $2,500, followed by a regular $50 a month contribution. If, over the forty-seven year period, you maintain a return on investment of 10 percent and the vehicle you choose is tax-deferred, by the age of sixty-seven, you are a millionaire!

• Power of compound interest & reinvestment of dividends - Understanding geometric interest progression (logarithmic, exponential, elliptical, parabolic like a population chart ascent; as opposed to arithmetic or linear like a straight line acclivity.) Einstein called compound interest one of the miracles of nature. Therefore it is important to be on the credit and not the debit side of interest and to compensate for inflation, taxes, and commissions. Starting to save and invest even a year or two earlier than planned makes a huge difference in this pattern.

• Difference of even one percent taken by inflation, taxes, commissions or a lower yield over time is tremendous. Consequently, the more important decision than any specific stock or fund choice is to put away as much as you can (the maximum amount if possible) in a tax deferred investment (e.g. an IRA or 401K.) The tax-deferred status engenders a colossal variance over a long time frame.

• Save and invest ten Percent of all you receive (20% if at all possible; 5% if you’re really living hand to mouth) - A part of all you earn is yours to keep. Pay yourself first. Put away 10% before paying for food, shelter, debts, bills, needs, gifts, indulgences. Do not suppose that any amount is too small. Wealth grows from a tiny seed. The more the seed is nourished and watered with savings, the sooner contentment comes. Make your treasure work for you. Every dollar invested is a servant working for you; a child that begets another child to achieve for you. Resist temptations to spend the 10%. Pretend it doesn’t exist. Pretend you received a pay cut or no recent raises in salary and put that money away. You will not find yourself shorter of funds or poorer without the 10%. Most people spend as much as they earn, no matter how much, and still feel short of money. Satisfaction and success eventually encourages you to save and invest more than ten percent.

• Dollar Cost Averaging - Investing the same dollar amount every week or month. As with reinvested dividends, this will have the effect of buying more shares when the price is low and buying less when the price is high. Furthermore, if the stock is volatile, this can actually be advantageous as more shares will be accumulated over time than if the price was stable.

• Rules of 72 - yield = 72/years to double money or 72/yield = years to double money Rules of 110 - yield = 110/years to triple money or 110/yield = years to triple money.

• P/E Ratio - Price/Earnings Ratio or multiple is the price of the stock divided by its earnings per share. It gives investors an idea of how much they are paying for a company’s earning power. The higher the P/E, the more investors are paying, and therefore the more earnings growth they are expecting. High P/E stocks (with multiples over 20) are typically newer, fast-growing companies. They are riskier, but with more growth potential than more established companies which usually have a lower P/E ratio.

• Technical Analysis - A study in market action. The basic premises are:

1. Markets ignore most factors that are usually thought of as important (such as fundamentals.)

2. Prices move in trends.

3. History repeats itself.

• The lottery is an additional tax on people who don’t understand arithmetic. The same can be said of contests and gambling. More to the point, perhaps, the odds are further against you in these endeavors (i.e. lottery, contests and gambling in terms of your time as well as your money) mathematically than you can possibly imagine and more in alignment with you than you can dream, if you follow common sense principles of saving and investing.

• Finally, to illustrate in the extreme that point about the power of compound interest (though granted, a peculiar example you will not see in real life): The answer to that thirty day question above is that you would be given $5,368,708.80 on the thirtieth day if you chose to double the one cent each day. Then double that amount to account for the previous days and you’d have $10,737,417.60 as opposed to $30,000 total you’d receive given the alternate choice. (Remember, think geometric rather than arithmetic.)

The Psychology of Investing:

• Awareness of your temperament and attitude and expectations is more important than your individual investment decisions. You should also be cognizant of your time horizon, how much volatility you can handle and you must have realistic expectations.

• Discernment of your issues and fears concerning money and your habits of spending and saving.

• Irrational Decisions, Expectations or Exuberance - Many are more likely to perk up at stock advice overheard from a stranger than through well thought out research and planning. A decision on any investment should not be made based on only one source of information or on the same day you hear about it.

• Know what your investments are and what they do. The reason I asked for a definition of a bond before is that most people are invested in bonds without even knowing exactly what it is. Moreover, most who are invested in a mutual fund could not tell you what companies make up that fund or what those companies do. You need to know the nature of your investments so you can judge the wisdom of holding them as trends and circumstances change.

• Investing should be fun and informative. If it’s causing stress and worry and second guessing, you might be doing something wrong or have the wrong attitude or expectations. Being able to sleep at night as a result of your decisions is an extremely important consideration.

• Gambling mentality inherent in investing - Chasing a loss to get even; chasing a gain or keeping in play when investment going up thinking you’re on a roll. When you have money on the table (in the market) you’re afraid it will be lost; when you don’t, there can be a desperation to get on board if you feel everyone else is making money.

• Becoming too attached to a stock is a bad policy. Be willing to part with your least profitable investment (assuming you have at least five, as you should) even if it is an old favorite that was once profitable.

• Long term patience vs. instant gratification (Infinite patience produces immediate effects.) Going in and out of a stock is like changing highway lanes or supermarket lines. Try not to second guess yourself if your original reasons were sound. Remember the reason you bought the investment; has that changed? (See stock fluctuation reasons above.)

Perceptions and Misconceptions about Operations of the Markets:

• Learning which financial vehicles rise and fall when and why. The nature of stock prices (expensive or oversold; purpose of stock splits; lower price, more liquidity.) A company may be great, but its stock a poor investment or vise versa. A large company with many stockholders is less likely to be volatile (with large swings in price) than a smaller newer lesser known company. A company’s stock may rise, come out with a fantastic quarterly earnings report, then take a dive. There may be an announcement of a stock split, the stock price may rise, then the split occurs and the price dives; why? Diminishing expectations?

• People and institutions with money and time will take advantage of bargains without panicking at short-term news or situations. A stock is never only being sold or exactly losing value except on paper; its just that people are willing to pay less. Somebody is noticing a good reason for buying the stock even when the price is falling; somebody is seeing good rationale for selling even when the price is rising.

• Bargains - People react differently to stock bargains than in their other purchases. What if a shirt was 20% off last week’s price? Now what if a stock was 20% off last week’s price? People say: ‘Buy low, Sell high’, and that they don’t mind high levels of risk if it means greater rewards and higher profits, but that’s often not how they react when faced with a downturn.

• Contrarian Investing - Going against (contrary to) the pack mentality or the common belief of the street. Sometimes (but certainly not always) if everyone else believes the market (in general) or one stock (in particular) is great, it might be time for you to get out. Or using the same rationale, if everyone else is selling (the market in general or one stock specifically) it might be a good time to buy. Higher yields can be obtained from under-performers. To restate what I said earlier: Somebody is buying a stock even when the price is falling; somebody is selling even when the price is rising.

• Inside Information - By and large, those who know, keep silent; those who don’t know, talk. By law, someone on the inside of a company with confidential information cannot divulge it, even to family and friends. If it is information that creates a disparity or that will affect the market and will put the public at a disadvantage which cannot be overcome with research or skill, it is unethical as well as illegal to release it. And if they do, you are probably not the only one receiving the information (the insider is telling two friends and they’re telling two friends and so on and so on…. ) By the nature of the market, the greater the number of investors knowing the confidential information, the more the market will already have taken it into account. You will more likely be one of the last people on board The Greater Fool Theory. (See below.)

• The Greater Fool Theory - You can always make money in the market as long as there is a greater fool than you. In other words, if a stock is overpriced, you can still make money on it if there are people willing to overpay even more than you are willing to overpay. (But this theory is for speculators and most people don’t have the money or the reaction time to outmaneuver speculators, so don’t try.)

• Initial Public Offering (IPO) - When a company ‘goes public’, it offers shares on the market for the first time in an ‘initial public offering’.

• Significance of the individuality of the investor and the timing of the market. A good choice for one person can be a catastrophe for another. A good choice this month can be a disaster next month.

• Don’t be reticent about asking financial managers or advisors what you feel are stupid questions. First of all, there are no stupid questions when it comes to concern for your money. Secondly, you are not the first to ask those questions, therefore they are accustomed to being asked those questions. For instance, ask what his or her fee is for various investments (commission, flat fee, how it varies for each investment.) There is no wrong answer to this except if the advisor says they don’t know, its not your concern or beside the point or not important for you to know or its too complicated and you wouldn’t understand. If they give those type of answers, politely excuse yourself and go elsewhere for financial services.

• Excuses and procrastination in saving and investing - Discipline derives from willpower which comes from a willingness to do the work. If you are making excuses, year after year, you don’t really want to achieve your objective. There is something blocking. It might be old habits, fear of failure, fear of success, concern about other people’s opinion or just plain laziness. Dreams don’t work without action. No one can stop you from your goals but you. I frequently hear variations on the following: - - - - I’m too busy right now - - This is too complicated - - I don’t have enough money to begin saving and investing; you need a lot of money to do this - - I have too many debts and bills and responsibilities - - I’ll do this someday - - This kind of thing is okay for you, not me - - I’m too old, its too late - - I’m young, I have plenty of time - - Times are tough right now - - Something else has another priority right now. - - - - I don’t sympathize with these excuses. One person’s necessity is another person’s luxury. People who are busier, less intelligent, poorer, more in debt, older, younger, less healthy or have more children or family responsibilities than you have made these principles work. Other people with more time, opportunity and freedom than you can imagine still manage to find these and other excuses.

The Attributes of Debt:

Pay your debts. If you are continually borrowing or let years go by without repaying or acknowledging your debts, agreements and commitments, you may have the the temperament of a victim. Your word may not trusted a second time and yet you may never know the cost to you, since you might not be told directly.

Before I make my primary important point on the harm of debt (particularly credit card debt.) I will repeat some of the points I made earlier. Now try to imagine the reverse of these concepts and the results of having compound interest over time working against you instead of for you.

The principles in saving and borrowing are analogous:

Rule #1 is to avoid debt.

Rule #2 (which is useless until you follow Rule #1) is to strive to invest. The sooner you begin, the faster and more impressive the result. Regular contributions and accrued interest on a tax-deferred basis is critical to wealth-building. The catalyst for a regular investment program is compounded interest.

The power of compound interest and reinvestment of dividends - Comprehension of the attributes of interest progression is vital to the understanding of money. It is geometric (logarithmic, exponential, elliptical, parabolic like a population chart ascent; as opposed to arithmetic or linear like a straight line acclivity.) Therefore it is important to be on the credit and not the debit side of interest and to compensate for inflation, taxes, and commissions. Starting to save and invest even a year or two earlier than planned makes a huge difference in this pattern.

The difference of even one percent taken by inflation, taxes, commissions, a lower yield or debt over time is tremendous. Consequently, the more important decision than any specific stock or fund choice is to put away as much as you can (the maximum amount if possible) in a tax deferred investment (e.g., an IRA or 401K.) The tax-deferred status engenders a colossal variance over a long time frame.

Save and invest ten percent of all you receive (20% if at all possible; 5% if you’re really living hand to mouth) - A part of all you earn is yours to keep. Pay yourself first. Put away 10% before paying for food, shelter, debts, bills, needs, gifts, indulgences; and the next 10% to dissipate any debt. Do not suppose that any amount is too small. Wealth grows from a tiny seed. The more the seed is nourished and watered with savings, the sooner contentment comes. Make your treasure work for you. Every dollar invested is a servant working for you; a child that begets another child to achieve for you. Resist temptations to spend the 10%. Pretend it doesn’t exist. Pretend you received a pay cut or no recent raises in salary and put that money away. You will not find yourself shorter of funds or poorer without the 10%. Most people spend as much as they earn, no matter how much, and still feel short of money. Satisfaction and success eventually encourages you to save and invest more than ten percent.

Rules of 72: yield = 72/years to double money or 72/yield = years to double money Rules of 110: yield = 110/years to triple money or 110/yield = years to triple money

Credit cards are (like the lottery and gambling) an additional tax on people who do not understand arithmetic. More to the point, perhaps, the odds are further against you in these endeavors (i.e. buying on credit, lottery, gambling in terms of your time as well as your money) mathematically than you can possibly imagine, and more in alignment with you than you can dream, if you follow common sense principles of saving and investing (part of that is not to borrow.)

Now this is important. Appreciate this thoroughly and it can save you (and earn you) thousands of dollars: Think of the rules of 72 and 110. I don’t know the exact amount of debt you carry or how many credit cards you have or the amount of interest on the cards, but (since the number of cards, interest rate or amount of liability is not the primary issue) let’s say this: If your credit card is charging 18% and you have been carrying a maximum limit of $10,000 for four years, you are paying twice the original price of everything you have charged on your card! If it’s been six years of this debt, you’re paying triple every charge. And probably you’ve prided yourself over some great bargains you got while shopping or great deals on vacations. This is impeding the building of your investments, which has the potential to compound in your favor over the years.

If credit card companies included in their monthly statement (in the same manner as your investments) a detailed accounting of how much total interest you’ve paid over time and how much you’ve really paid for each purchase, the shock might hit home.

Here are some analogies between gambling and over-dependence on credit cards. Casinos know the psychological effect of every detail of their operation: Serving free drinks to cloud your judgment; Low lighting 24 hours a day without clocks to make you lose track of time; Easy credit via conveniently placed automated teller and credit machines (which like credit cards and chips don’t quite seem like real money at the time); Free or very cheap meals near casinos; Comp benefits (they don’t comp you unless they’re damn sure you’re losing far more than winning - if you’re consistently winning, they show you the exit - literally); The very loud clinking of coins from the slot machines giving the atmosphere and illusion that people are winning money; Allowing just enough percentage of winning to give people hope, even though the odds over time are always against them.

In a like manner, credit card companies know exactly what they are doing when they make credit easy or send new credit cards in the mail. They are very aware that a certain amount of people can’t afford it and will default, but due to the mathematics of interest alluded to earlier, they are making huge amounts of money from most people. Credit card companies have actually set up booths at high school and college events and practically give away credit cards knowing full well the kids lack the money and judgment to use them and that they will run up a debt, the interest will compound, then the kids will eventually shamefully go to their parents who will then bail them out and pay the interest-inflated bill. (Laws are starting to prevent this practice and schools are starting to throw the representatives of card companies off the campuses.) Credit card companies make zero profit from people who pay the entire amount as soon as the bill arrives. They want you to carry over debt each month.

Department stores often make as much revenue from their charge cards as from their products. Remember people often end up paying more than twice or triple the original amount when they charge and carry debt for several years.

Another parallel I find interesting is chips and credit cards. Chips don’t quite seem like real money while you’re playing. It’s almost like Monopoly game money. You’ll be likely to throw $20 chips on the table as if it were nothing, whereas if you had to put down the cash, you’d think a little more carefully about it. Likewise with credit cards: If you saw something you’d like to have (but could do without) and you had $50 in your wallet to pay for it, you might pass it by, but if you had a credit card, the decision to purchase the item seems much less of a problem.

I would say the only acceptable forms of debt are if it is used to purchase a home or an education, as these are very low interest and are themselves an investment in your future.

Keep in mind that the character of debt (especially over-dependence on credit cards) is exceptionally insidious and can abrogate all the excellent work and decisions that can go into your future investments. So be consistent with a plan of slowly eliminating the debt and building on investments and the rewards with be more amazing than I can explain.

Charts and Handouts:• Phases of the Economy and Associated Categories of Investments - (charts which represent, in oversimplified terms, the different cycles through which the economy passes and the types of financial instruments that perform best in each phase)

• Federal Reserve Indicators - (chart on how decisions made by the Federal Reserve Board affect each category of investments and the reverse)

• Mind Maps

• Inflation History

• Pyramid Risk Diversification

• Newsletters and an Explanation

• A Computer Technology letter I wrote for my sister which explains the basics of computers and the Internet as well as how computers and cyberspace change the nature of our thinking.

• Louis Rukeyser’s Crash Course in Confident Investing.

Miscellaneous (often confusing) Financial Nomenclature:• Short Sale - Selling a stock before you buy it in the belief that the price will drop. It is as if you sell a pencil that you don’t own and buy it later (for the first time after the sale) at a lower price. (When this concept was explained to Dwight Eisenhower shortly after he became president, he called it un-American.)

• Derivatives - a contract or security which is based on or derived from another contract or security or index or other source. Examples are options of futures contracts. Complex examples are securities where the interest rate depends on complex formulas involving foreign rates or securities which pay less as market rates rise (inverse floaters.)

• Futures - definite agreement to buy or sell a specific amount of a commodity or financial instrument at a particular price at a stipulated future date (carrying costs added)• Options - right (may but does not have) to buy or sell (insurance policy added)

• Triple Witching - Every three months (the third Friday of March, June, September,, when the expiration of options, index options and index futures (or options, futures and options on futures) occur on the same day.

• Federal Funds Rate - overnight lending rate charged by banks to other banks

• Discount Rate - interest rate that Federal Reserve charges to member banks

• Prime Rate - interest rate that banks charge to preferred or most creditworthy customers

• Bull Market - A market that is growing. This is the opposite of a bear market, which is declining.

• Bear Market - A bear market is one that is declining; that is, stock prices are falling, and so is the amount of money that companies have to spend on growth. This is the opposite of a bull market, which is growing.

• Theories of origin of terms (‘bull’ and ‘bear’ markets) - ‘bull’ used when there was a full bulletin board when heavy trading happening on the exchange and ‘bear’ used when bulletin board was ‘bare’ when there was little happening. Another possibility is ‘bull’ as a synonym of strong or good (bully) and ‘bear’ when bearskins traded when little else was available for trade.

Money Supply:

• M1 - cash and checking accounts

• M2 - M1 + consumer time deposits

• M3 - M2 + CDs over $100,000Index of Leading Economic Indicators:

The Federal Reserve Board uses these statistics to project the economy’s performance six months or a year ahead. These measurements are taken into account when decisions are made concerning interest rates and money supply:

• Average work week of production workers in manufacturing

• Average weekly claims for state unemployment insurance

• New orders for consumer goods and materials, adjusted for inflation

• Vendor performance (companies receiving slower deliveries from suppliers)

• Contracts and orders for plant and equipment, adjusted for inflation

• New building permits issued

• Change in manufacturers unfilled orders, durable goods

• Change in sensitive materials prices

• Index of stock prices

• Money Supply: M2, adjusted for inflation

• Index of Consumer Expectations

Other Economic Indicators:

• consumer price index (CPI)

• purchasing price index (PPI)

• gross domestic product

• capacity utilization and factory usage

• industrial production capacity

• housing starts

• retail sales

• auto sales

• personal income

• manufacturing jobs

• service jobs

• private payrolls

• business inventories

• durable goods

• book to bill ratios

• oil prices

• precious metals prices

Federal Reserve Board Policy and Business Activity

A description of the role of the Federal Reserve System:

1. Over time, money has become less tied to anything real or practical, but it has always ultimately been based on agreement between people about value. For example, when money was cattle, people agreed that the value of a service or whatever was so many cattle and not more or less.2. The gold standard did not guarantee price or economic stability. The value of gold and silver always fluctuated based on how much of each was being mined, and while their value in comparison to each other was supposed to be stable based on this ancient alchemical relationship, in reality that changed a lot too.

3. During the Civil War, Lincoln issued "greenbacks" for the first time in US history. This was money not based on gold, backed solely by government promise. This caused a boom, because there was more money available for people to start or expand businesses. After the war, government went back to the gold standard, causing massive deflation, hitting farmers hard. Also, because the gold standard limited the amount of money available, frontier banks did not always have enough cash reserves to back loans farmers asked for seasonally, as well as their deposits. This caused 'bank runs" - when rumors flew that a bank was running out of cash, people raced to withdraw their money so they wouldn't lose it when the bank failed. Farmers organized the Populist movement, which wanted government to go back to greenbacks and abandon the gold standard. They called for an "elastic currency," which would make credit available when it was needed, rather than being tied to gold markets. They demanded democratic control of money, thru elected government. They were scorned as hicks by the East Coast banking industry, who saw a threat to their control over money. William. Jennings Bryan was kind of Populist, but watered down.

4. The Federal Reserve System started because of the problems the Populists identified. It wasn't born from their movement, but government and East Coast bankers eventually figured out that an elastic currency was necessary to create more stability in the economy (because credit demands are seasonal). The big NY banks used to cooperate (under JP Morgan's leadership) to bail out failing banks, but around the 1900s, this happened a lot and they even had to bail out the government. Eventually they realized they needed elastic currency. The Fed was a compromise between private banking interests and public democratic interests. The privates made out way better. The Fed is highly anti-democratic - its structure is based on distrusting public opinion about monetary policy. Its culture tries to maintain the "mystique of central banking," the attitude that these things are too complicated for normal people to understand. The Fed is not "privately owned," though part of its governance comes from private banking. It is protected from government oversight by the length of its governors' terms and by the freedom they have to determine monetary policy. Basically, it's like the government said, "We appoint you to do this job, but we won't tell you how to do it or hold you accountable for how you do it."

5. The Fed controls how much money/credit there is by adjusting interest rates and by buying and selling government securities. Money is created and destroyed simply by entering and erasing numbers in an electronic ledger. One Fed chairman described the Fed's role as "leaning against the wind" -- the Fed should moderate growth and contraction in the economy by adjusting monetary policy to slow speculative investing or to boost flagging investment. An important question that doesn't get addressed directly is who benefits? The US has two classes - creditors and debtors. Inflation actually aids debtors, as long as wages rise at the same or higher rate, because loans they take out during an inflationary period, they pay back in depreciated dollars.

Business Cycles:

An oversimplification of classical economics is that the economy runs in cycles. These phases used to last about twenty years; now its closer to four. One reason these cycles are now on a four year basis is elections. In an election year, difficult or unpopular, but necessary choices on taxes, spending and interest rates are less likely to be made by the President, Congress or the Federal Reserve Board.

These cycles are Recession, Growth and Inflation. In reality, these phases overlap and are not so clearly defined across the whole economy. (Some industries or parts of the country may be doing well while others are not.) However, a good rule of thumb is that different classifications of financial instruments perform in some cycles better than others. The catch is we don’t know precisely which phase or cycle is occurring until we are well into or passed it, therefore one needs a balance of funds (i.e., diversification.)

During a Recession, consumer demand as compared to available goods and services has slowed. There are often controls on monetary growth in order to cool down a previous inflation. Interest rates are comparatively high. Loan capital becomes extremely tight. Business falls off. Unemployment rises and investment markets become extremely sluggish. Interest-based or fixed-rate instruments are likely to be the safest investment in a recession, since rates are higher and the principle and rates are more likely to remain stable and guaranteed even though stock prices are dropping and business activity is slowing.

During a period of Growth, money supply increases. Interest rates are lower, in part due to Federal Reserve action to stimulate growth. More investors turn to the stock market, since the interest-rate instruments are returning less profit. Consumer demand picks up, therefore business starts to expand, therefore lower unemployment occurs. Investor confidence is up therefore stocks continue to rise. In this period, stocks are always the best investment. If you’re looking at a long term horizon, as you always should, stocks will always out perform almost anything else. One possible exception is real estate, particularly your own family home.

In a period of Inflation, prices have risen due to increased consumer demand. An increased supply of money is allowed into the economy. But soon the supply of money outpaces the supply of goods and services and inflation accelerates. Investment capital decreases, stocks drop and business slows. Interest rates rise, however due to the inflation, the real value of interest rates of bank accounts, money market funds and bonds will be eaten away by a devalued dollar. At this point, the only classification of investments that hold their true value (and therefore appear to be gaining in value since the dollar is dropping) are inflation hedging investments, for example, hard intrinsic assets such as precious metals and real estate.

Interest-Based or Fixed-Rate Vehicles - Recession Phase

• Bank Accounts (savings & checking accounts)

• Money Market Funds

• Certificates of Deposit

• Electric & Gas Utilities (though they are stocks, they behave more like bonds since they don’t fluctuate as much as most stocks and pay higher dividends than most stocks)

• Treasury Bills

• Government Bonds

• Municipal Bonds

• Corporate Bonds

• Zero Coupon Bonds

• Insurance Annuities

• Real Estate Investment TrustsSecurities - Growth Phase

• Stocks

• Mutual Funds (stock based)

• Business Investments & FranchisesTangible (Hard) Assets - Inflation Phase

• Gold & Silver Bullion & Coins

• Real Estate

• Mining Stocks

• Rare Coins & Collectibles & Art & AntiquesSpeculative

• High Yield Bonds (derisively called junk bonds)

• Derivatives

• Currency & Commodity Options

• Currency & Commodity Futures

• Farm Properties

• Gold Shares

Due to profound revolutions in the technology of integrated circuits, the Internet, advanced modems, microwave beams and fiber-optics (replacing traditional coaxial cable), the technology of computers, telecommunications and cable TV began overlapping and becoming interchangeable. This is reflected in all the corporate agreements, mergers, and acquisitions of these classifications of companies and in the Telecommunications Act of 1996. Any company in any of these sectors that did not have their fingers in all three pies had difficulty competing and needed to restructure, reorganize, merge, be taken over, establish close working agreements with other companies or run the risk of bankruptcy.

The sectors that were profitable in the 1990s: Software, hardware, PCs, integrated logic, programmable memory chips, semiconductor circuitry, microprocessors, telecommunications, telephone equipment, network, database, operating systems, printing, broadcasting and cable television.

Technical Analysis and Fundamental Analysis:

Fundamental Analysis is the study of the fundamentals of the market. Fundamentals are all things that affect the supply and demand of the underlying commodity. For example, if you were analyzing the price of wheat and you thought that the price of wheat was going to go up because there is a draught in the Midwestern United States, then you would be basing your analysis of the wheat market on fundamentals.

Technical Analysis, on the other hand, is the study of the market based on a chart of its price data like the one above. If you were to look at the chart of the price of wheat over time and saw that the price of wheat is the lowest it has been in 20 years, then you are said to be using Technical Analysis. You do not need to know anything about the underlying commodity to be a Technical Analyst and that is one of the advantages of being a Technical Analyst. If you wanted to study the fundamentals of Coffee, then you would want to know everything about coffee: how it is grown, what the planting cycles are, who the big buyers of coffee are, what are their plans in the future and how would that affect the demand for coffee and so on. The problem in researching coffee is that it takes a very long time to find out this information and then even more time to examine and interpret it. Technical Analysts claim that all of the fundamentals, or things that affect the price of a commodity, are shown on the price chart anyway. This actually makes sense if we think about in terms of the laws of supply and demand: if the supply of coffee goes up and the demand stays the same then the price will go down. This supply and demand relationship can be seen as a price drop on a price chart.

Resources:

• Barron’s Dictionary of Finance and Investment Terms

• Buckley, P. & Casson, M. - Economic Theory of the Multinational Enterprise

• Clason, George S. - The Richest Man in Babylon

• Fosback, Norman G. - Stock Market Logic

• Galbraith, John Kenneth - Money - Whence it Came, Where it Went

• George, Henry - Science of Political Economy

• Goleman, Daniel - Emotional Intelligence

• Greider, William - Secrets of the Temple - How the Federal Reserve Runs the Country

• Heilbroner, Robert L. - The Worldly Philosophers

• Kennedy, Paul - The Rise and Fall of Great Powers

• Lynch, Peter - One Up on Wall Street

• Microsoft Microsoft Bookshelf Encyclopedia CD

• Murphy, John J. - Intermarket Technical Analysis

• Needleman, Jacob - Money and the Meaning of Life

• Peters Tom - Thriving on Chaos

• Rukeyser, Louis - Crash Course in Confident Investing

• Sinetar Marsha - Do What You Love, The Money Will Follow

• Smith, Adam - An Inquiry into the Nature and Causes of the Wealth of Nations

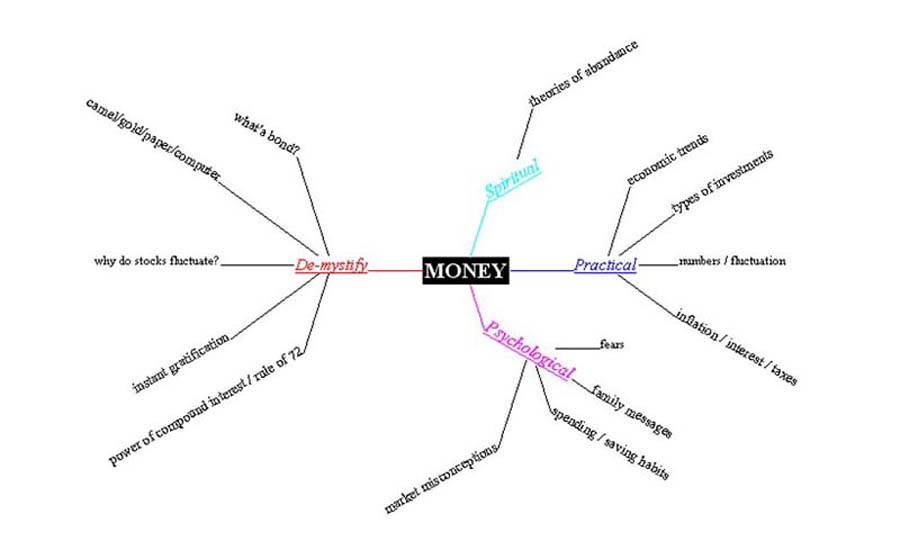

Above is a mind map that formed the basis of the lectures outlined on this page. The subjects evolved from my work at Charles Schwab brokerage where I gave talks attempting to reconcile the contrasting environments, controlling factors, and terminology of the brokerage and computer sides of the business. This was organized by researching and explaining the type of data in each database and how applications processed and updated financial details. The lectures were also based on my knowledge of history and economics and on my interest in the mythology and significance of money and gold (their practical, psychological and mystical dimensions.) Outside of Schwab, I first gave a version of the discourse to Intuitive Investors (an investment club.)